Retirement planning is one of the most critical aspects of personal finance, yet many people struggle with the question: How much do I actually need to retire? The answer depends on multiple factors, including your lifestyle, location, healthcare costs, and sources of income.

While a $1 million nest egg is often recommended, this may not be enough—or may even be too much—depending on your personal circumstances. In this article, we’ll break down the key elements of retirement planning, how to calculate your own retirement number, and strategies to help you reach your financial independence goals.

1. The 25x Rule and the 4% Safe Withdrawal Rate

One of the most popular formulas for estimating retirement needs is the 25x rule, which is based on the 4% rule.

- The 25x Rule: Multiply your estimated annual retirement expenses by 25 to determine your target savings.

- The 4% Rule: Withdraw 4% of your savings per year to make your money last for at least 30 years.

Example Calculation

If you expect to spend $60,000 per year in retirement:

📌 $60,000 x 25 = $1.5 million (required savings)

With this amount, withdrawing 4% per year ($60,000) should allow your money to last. However, factors like inflation and healthcare costs can impact this amount.

2. How to Calculate Your Personal Retirement Number

Instead of relying on generic formulas, you can calculate your own retirement number using these steps:

Step 1: Estimate Your Annual Retirement Expenses

Your expenses in retirement will differ from your working years. Consider these categories:

✔ Housing Costs – Rent, mortgage, property taxes, maintenance

✔ Healthcare – Medicare, insurance, medical bills, long-term care

✔ Daily Living Costs – Food, utilities, insurance, entertainment

✔ Travel & Leisure – Vacations, hobbies, memberships

✔ Inflation Adjustments – Plan for a 2-3% annual increase in costs

A general rule is that retirees need 70-80% of their pre-retirement income each year.

Step 2: Factor in Inflation and Longevity

Inflation reduces purchasing power over time. If you expect to retire in 20 years, expenses that cost $50,000 today may cost $90,000+ in the future.

Additionally, increased life expectancy means you may need savings for 30+ years of retirement.

Step 3: Consider Other Sources of Retirement Income

Your savings won’t be your only source of income. Factor in:

- Social Security: The average monthly benefit in 2024 is about $1,800.

- Pensions: If available, pensions can cover some expenses.

- Investments & Passive Income: Rental properties, dividends, and annuities can provide income.

If your annual expenses are $60,000, but you expect to receive $25,000 from Social Security and pensions, your savings only need to cover $35,000 per year. Using the 25x rule:

📌 $35,000 x 25 = $875,000 (instead of $1.5 million).

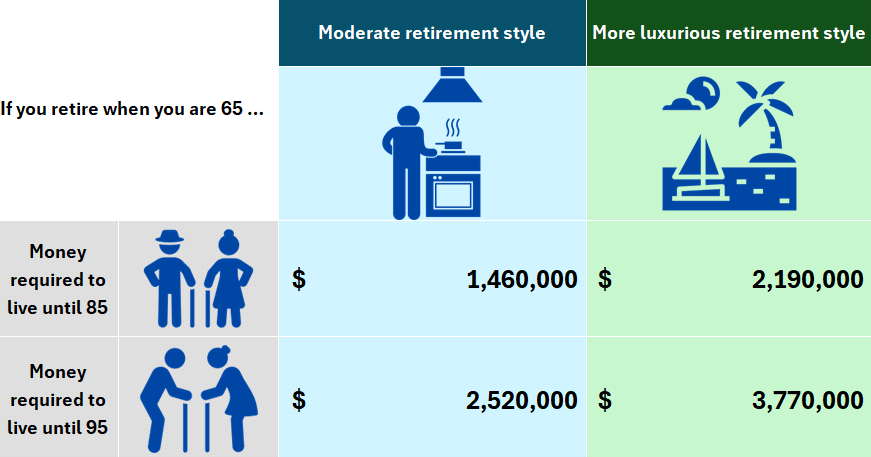

3. How Different Retirement Lifestyles Affect Savings

Your required savings depend on your lifestyle. Here are three common retirement scenarios:

1. The Frugal Retiree ($500,000 – $1 Million Needed)

- Lives in a low-cost area

- Owns a paid-off home

- Spends modestly on travel and entertainment

2. The Comfortable Retiree ($1 – $2 Million Needed)

- Lives in a medium-cost area

- Travels occasionally

- Enjoys dining out and leisure activities

3. The Luxury Retiree ($2 – $5 Million Needed)

- Lives in a high-cost city or has multiple homes

- Travels extensively

- Spends on luxury hobbies and entertainment

4. Best Retirement Savings Strategies

To build your retirement fund, use these strategies:

1. Maximize Contributions to Retirement Accounts

- 401(k) Contributions: Up to $23,000 (2024 limit), with employer matches.

- IRA Contributions: Up to $7,000 ($8,000 if age 50+).

2. Invest for Long-Term Growth

To outpace inflation, invest in:

- Stocks & Index Funds (historical return: 8-10% per year)

- Real Estate (rental income potential)

3. Reduce Debt Before Retirement

Paying off high-interest debt (credit cards, mortgages) reduces financial stress.

4. Create Passive Income Streams

Consider:

- Rental properties

- Dividend stocks

- Online businesses

5. Use a Retirement Calculator

Online retirement savings calculators help estimate your goal.

5. Adjusting Your Retirement Plan Over Time

Your retirement plan should be flexible. Adjust your savings strategy by:

✔ Reevaluating Annually – Track savings progress and investment growth.

✔ Adjusting Your Lifestyle – Reduce expenses if savings fall short.

✔ Planning for Healthcare Costs – Consider long-term care insurance.

If you’re behind on savings, consider:

- Delaying retirement by a few years

- Downsizing your home

- Increasing investment contributions

6. Common Retirement Planning Mistakes to Avoid

🚫 Underestimating Expenses – Healthcare and long-term care can be costly.

🚫 Not Accounting for Inflation – Failing to adjust for rising prices can deplete savings.

🚫 Relying Too Much on Social Security – Social Security alone isn’t enough.

🚫 Investing Too Conservatively – Avoid keeping too much cash instead of investing for growth.

Final Thoughts: How Much Do You Really Need?

There is no universal answer to how much you need to retire—it depends on your expenses, income sources, and lifestyle. While the 25x rule provides a benchmark, a personalized approach is best.

🔹 Estimate your expenses

🔹 Factor in inflation and healthcare

🔹 Maximize savings and invest wisely

🔹 Use Social Security and passive income to supplement savings

By planning early and making adjustments as needed, you can achieve a financially secure and stress-free retirement.

💬 How much do you think you’ll need for retirement? Share your thoughts in the comments!