If you’re wondering ‘Is It Too Late to Invest?’ — you’re not alone. Many people feel uncertain about entering the stock market when it’s near all-time highs or after years of growth. But here’s the truth: It’s almost never too late to invest.

Whether you’re in your 30s, 40s, or even 50s, you still have time to build wealth — and the data backs it up. In this post, we’ll walk through 5 compelling reasons why you shouldn’t wait any longer to invest, plus historical stats that show how time in the market beats trying to time it.

Time in the Market Beats Timing the Market

Trying to ‘buy the dip’ or wait for a crash is one of the biggest traps beginner investors fall into. In reality, even professional investors can’t consistently time the market correctly. What matters more is how long you stay invested.

A Fidelity study showed that investors who missed the 10 best days in the market over a 20-year period had returns cut in half. Instead of chasing the perfect moment, focus on consistency and long-term exposure to the market. Historically, the S&P 500 has delivered positive returns over 5–10 year periods, even when investments started at all-time highs.

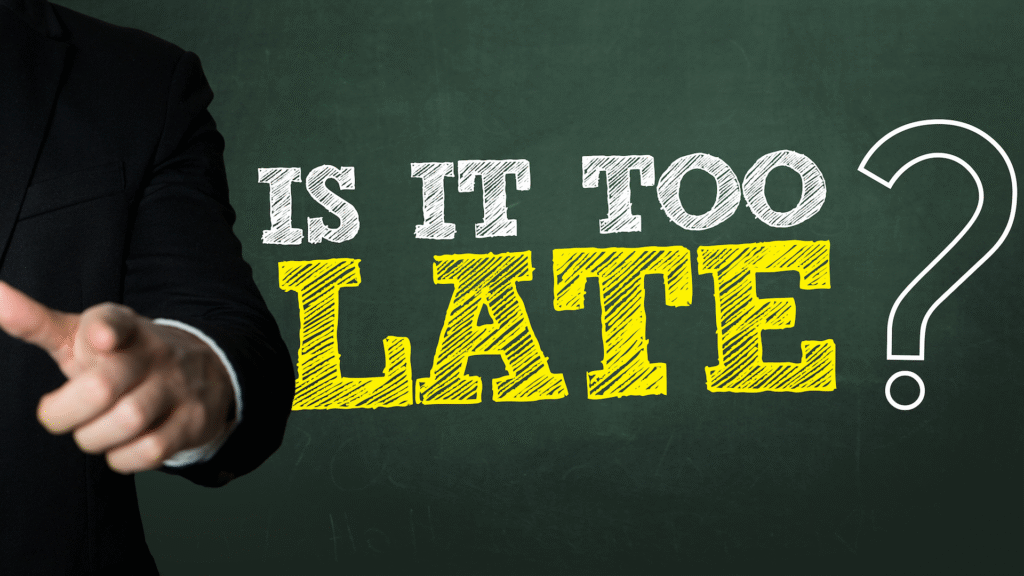

Compound Growth Works at Any Age

The power of compound interest lies in time. The longer your money is invested, the more your returns generate their own returns. Even if you start investing later in life, compound growth can still work for you.

Let’s say you invest $500/month with a 7% annual return. After 20 years, you’d have over $250,000. It’s not magic—it’s math. Even if you’re starting in your 40s or 50s, consistent contributions and smart asset allocation can still build a strong retirement portfolio.

Below chart shows how investing just $500/month at 7% annual return grows over 30 years.

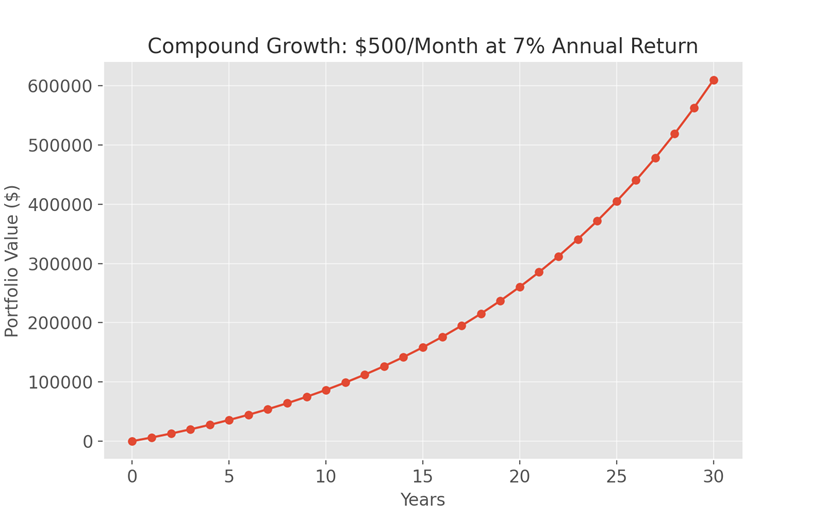

Markets Always Recover From Crashes

Many people fear investing because of volatility and potential crashes. But history shows that every major downturn has eventually recovered — and often surged beyond previous highs.

For example, after the 2008 recession, the S&P 500 grew over 400% between 2009 and 2020. The COVID-19 crash of March 2020 saw markets rebound to record highs within months. If you stay invested during downturns instead of selling in fear, you give yourself the opportunity to benefit from the recovery.

Below chart visualizes how markets crash but eventually recover—and grow stronger.

Dollar-Cost Averaging & Diversification Reduce Risk

One of the smartest ways to start investing — especially during uncertain times — is to use dollar-cost averaging (DCA). This strategy means investing a fixed amount regularly (e.g., monthly), regardless of whether prices are high or low.

It smooths out market volatility and helps you avoid emotional decision-making. Combine that with diversification — investing across sectors and asset types — and you build a portfolio that’s designed to handle both growth and downturns.

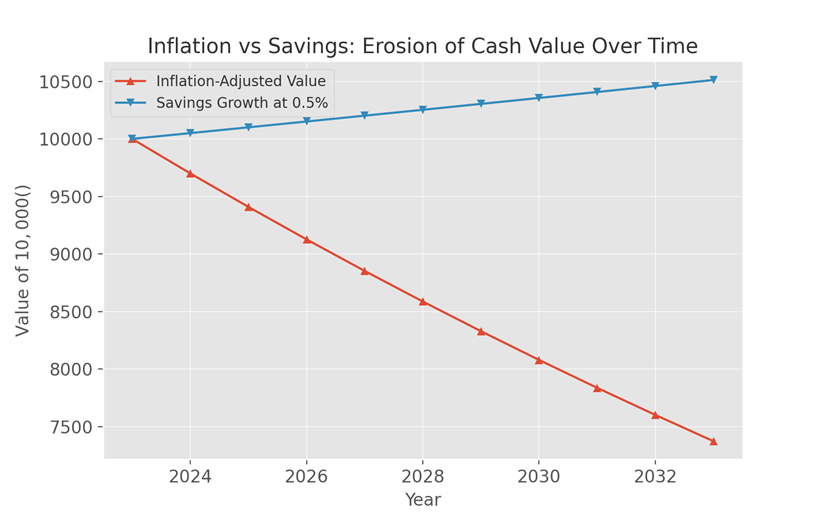

Inflation Is the Silent Wealth Killer

If your cash is sitting in a savings account earning 0.5% while inflation is 3–4%, you’re losing money every year — even though your balance looks the same.

Investing is one of the few strategies that can outpace inflation and preserve your purchasing power. Even conservative investments like index funds or ETFs often earn 6–8% annually over the long term — easily beating inflation. Not investing is also a risk — the risk of falling behind financially.

Below chart demonstrates how keeping money in low-interest savings erodes value over time.

Final Thoughts: Is It Too Late to Invest – NO! Start Now, Not Later

Markets may look expensive right now, but over a 10- or 20-year time horizon, what matters most is your time in the market, not your timing of it.

📌 Start with what you have.

📌 Be consistent.

📌 Automate your contributions.

📌 Stay invested through the ups and downs.

Here is an interesting read from The Motley Fool –

https://www.nasdaq.com/articles/sp-500-around-its-all-time-high-it-too-late-invest-index

Is It Too Late to Invest – Answer is “It’s not too late”. In fact, it’s never been more important to start today.